The CA Quarterly Review (Spring 2023)

NEWS & INFORMATION QUARTERLY FOR OWNERS AND AGENTS OF THE PERFORMANCE BASED CONTRACT ADMIN FOR tennessee

- Get Ready for Spring Cleaning—Records Retention Requirement Reminders.

-

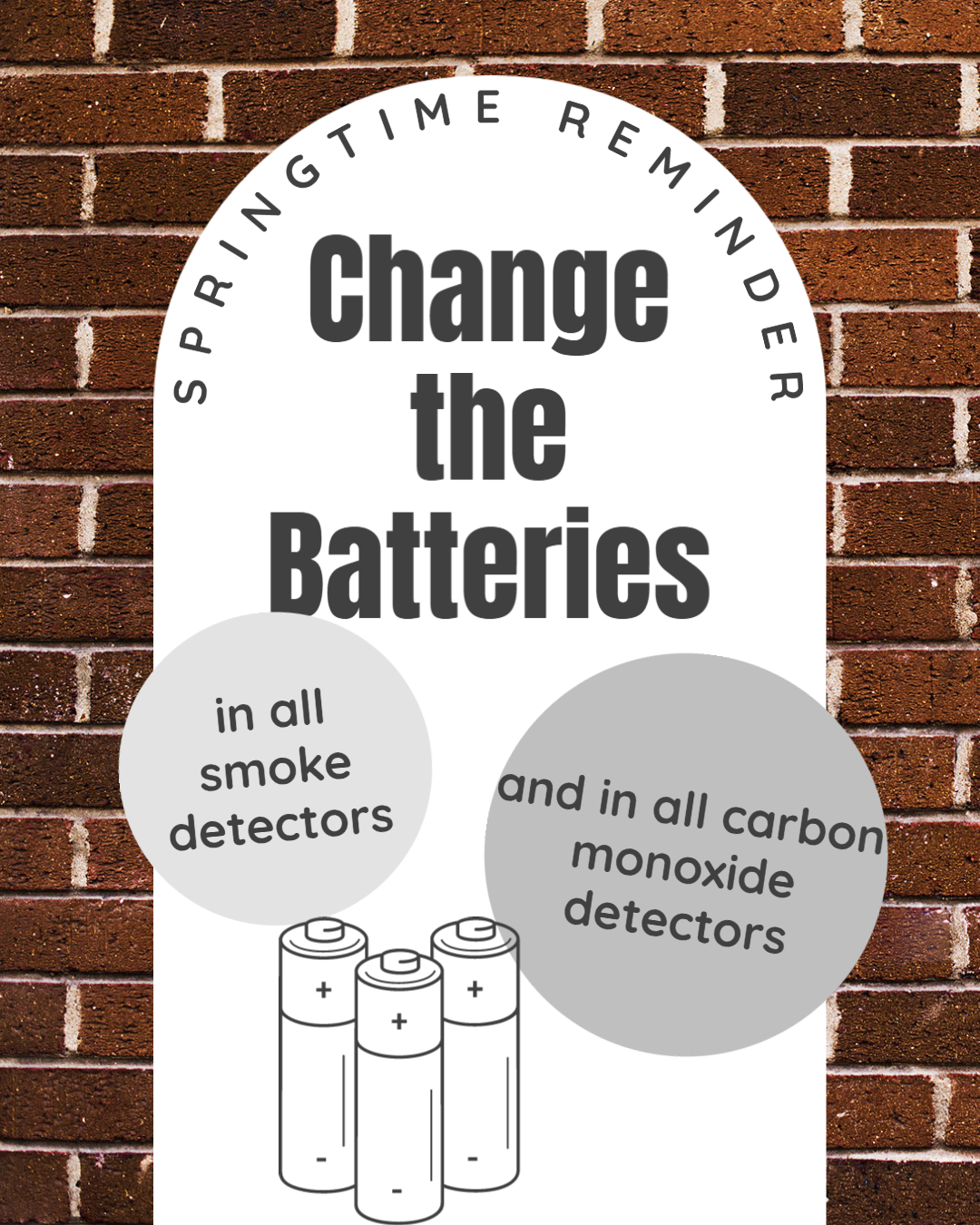

As we enter the spring months, now is the perfect time to conduct a thorough spring cleaning of your files. In order to facilitate your ‘out with the old, in with the new’ spring attitude, here are some reminders about record retention requirements.

Applicant File Retention – HUD Handbook 4350.3 Chapter 4, 4-22

Applicant Files must be maintained from the time the application is accepted, through the wait list period and for three years after the applicant is removed from the waist list.- The current application must be retained as long as applicant is active on the waiting list.

- If the applicant was removed from the waitlist, then the application, supplement to application (HUD 92006), initial rejection notice, applicant reply, copy of the owner’s final response and all documentation supporting the reason for removal must be retained for three years.

- After an applicant moves in to the property the application and supplement to application (HUD 92006) must be maintained in the tenant file for the term of tenancy plus three years.

Resident File Retention – HUD Handbook 4350.3 Chapter 5, 5-23

Resident files (all documentation) must be maintained for the term of tenancy plus three years thereafter.- Owners must keep the following documentation in the resident file:

- All original, signed HUD 9887s and 9887As;

- A copy of signed consent forms;

- A copy of the EIV Income Report, the HUD 50059 and any other documentation obtained supporting rent and income determinations; and

- Any third party verifications

Retention of EIV Reports – HUD Handbook 4350.3 Chapter 9, 9-14

- The Income Report, Summary Report and the Income Discrepancy Report along with any supporting documentation must be retained in the resident file for the term of tenancy plus three years.

- Any tenant provided documentation to supplement the Social Security Administration or National Database of New Hires data must be retained in the resident file for the term of tenancy plus three years.

- Results of the Existing Tenant Search must be retained with the application:

- If the applicant was not admitted, it must be retained with the application for three years.

- If the applicant was admitted, it must be retained in the resident file for the term of tenancy plus three years.

- The master file containing the New Hires Report, Identity Verification Reports, Multiple Subsidy Report and Deceased Tenant Report must be retained for three years.

Once the retention period has expired for all of the above listed requirements, owners must dispose of the data in a manner that will prevent any unauthorized access to personal information (shred, burn, pulverize, etc.). It is recommended to review the above requirements once a year to ensure unnecessary documentation is being kept and stored on-site.

Many residents may reside at a property for multiple years and this will cause the resident file to become quite large. Owners may choose to move/reduce the files sizes located at the property; however, it is recommended to keep all move-in documentation along with the most recent five years’ worth of recertifications. If file documentation is removed from the property it must be kept in secure storage, the documentation cannot be destroyed. It is recommended to include this policy in an owner/agents written management procedures.

Happy Spring cleaning!

- Proposed Changes to the HAP Contracts

-

The information in this article was initially published by Federal Register. You are strongly encouraged to read the Federal Register notice in its entirety, as this article is only a summary.

As an Owner/Agent, you are likely aware of the type of HAP contract your property is currently under. Properties who are currently under an Option 2 or 4 contract, are under a Basic Renewal Contract. Properties who are currently under an Option 1 contract, are under a Mark up to Market Contract. Properties who are currently under an Option 3 contract, are under an Interim Full or Interim Lite Contact, or perhaps under a Full M2M Renewal Contract. And properties under an Option 5 contract, are under a Preservation Renewal Contract.

However, on 2/2/2023, HUD released a proposal that would essentially reduce the complexities associated with administrating the different types of contracts. HUD is proposing a single standard renewal contract for all projects renewing under section 524. Per the federal register notice, “HUD sees a clear benefit to moving toward a single program regulatory structure and a single program contract that sets forth all contract terms”. HUD recognizes the impact that this will have on an owner’s decision-making process on whether to request a renewal. For this reason, the Office of Multifamily Housing Programs (MFH) is calling for public comments concerning this initiative.

If you are new to the Request for Public Comment process, this is when you have a chance to voice your concerns and provide input on new policies being introduced. MFH will not only consider all public comments within the initial 40-day period but will also issue a subsequently proposed rule after considering those said comments, to allow another public comment period on the proposed standard program regulation.

Please visit the Federal Register link above to find details on how to submit comments by mail or electronically. On this site, FMH included several subject areas to consider and comment on such as:

- HUD’s intention on making it a requirement to establish a HUD-controlled Reserve for Replacement account. Owners will also be required to submit annual financial reports to ensure compliance with the RfR requirement.

- To provide clarity and transparency, HUD intends on including in the regulation a subpart on HUD enforcement.

- HUD expects to incorporate into the regulation tenant rights equivalent to current rights that apply to tenants residing in projects assisted under RAD PBRA HAP contract.

- For projects within MFH’s portfolio eligible for renewal under section 524 of MAHRA, when owners are to renew, HUD intends on requiring renewal by means of the single standard program contract. Owners will be subject to the requirements laid out in the standard program regulation.

FMH would also like your input on additional items that may be beneficial to include such as:

- In terms of rehabilitation, should the standard program regulation address requirements when a project is undergoing rehabilitation? Examples include rehabilitation planning, tenant relocation, use of a pass-through, etc.

- As for vacant units, should HUD include incentives to encourage owners to re-lease vacant units quickly such as vacancy payments? Are there programmatic changes HUD might consider encouraging this result?

- Should the regulation be comprehensive, addressing all aspects of the program, ranging from renewal, management, occupancy, enforcement, and nondiscrimination accessibility for persons with disabilities and equal opportunity requirements?

If you indeed have comments on any of these topics, please note, comments must be submitted no later than April 3, 2023.

- COVID-19 Antigen Test Kit Ordering Portal for Section 202 Housing for the Elderly

-

The information in this article was initially published by hud.gov.

Good news Owner/Agents! The U.S. Department of Housing and Urban Development and the U.S. Department of Health and Human Services are making COVID-19 antigen test kits available to Section 202 Housing for the Elderly properties free of charge. Owners and site-based staff at these properties can register to order test kits on a weekly basis to be delivered directly to their properties. Nice right?

So, what properties are eligible to receive these free test kits? Properties serving older adult residents that have current or past Section 202/8 or Section 202 Capital Advance and/or rental assistance from HUD. These properties are eligible to receive free test kits.

When registering a property, keep in mind that registrations and ordering should be done on a property-by-property basis. If you are an owner or manager of multiple properties, you must register each property separately. Also, when registering, you must provide your iREMS number and that iREMS number is used to confirm the property name and address. If the property name and address doesn’t match the iREMS number, the registration will not be approved.

If you are wondering how may kits you should order, 1 package contains 45 test kits and each kit includes 2 tests. Properties should not stockpile or order test kits in advance but should order enough test kits to cover the number of kits needed for their residents on a weekly basis. So, if a property has 45 residents, you may anticipate using 90 tests per week which is 1 package. This is reasonable.

Visit hud.gov to see if your property is eligible to receive these kits, to find your iREMS number if you are unsure, and for detailed instructions on how to register and order COVID-19 test kits for free!

- HUD Issues Unique Entity Identifier Notice

-

The information contained in this summary was originally published by HUD on January 26, 2023 via HUD Notice 2023-01.

The federal government is transitioning from using the Dun & Bradstreet Data Universal Number System (DUNS) to the Unique Entity Identifier (UEI).

HUD is unable to allocate funds for an ownership entity or grantee that has not yet registered its UEI with the federal government’s System for Award Management (SAM.gov). This initial change of discontinuing the use of the DUNS and instead using the UEI was implemented back on April 4, 2022.

Owner/agents are encouraged to read the full HUD Notice as it also provides information on resources that are available to assist with the transition, and discusses any TRACS implications.

- TRACS User Certifications and Training Requirements

-

HUD recently revised the TRACS External User Access/User Recertification/Security Awareness Training Guide, which outlines HUD’s initiative to ensure that 100% of affordable housing stakeholders receive the required annual Information Security Awareness Training and role-specific training, prior to gaining access to the Tenant Rental Assistance Certification System (TRACS) and Multifamily Access exchange (iMAX) applications for new and current user(s) and coordinator(s).

Each year, TRACS Coordinators must certify TRACS Users when those Users still need access to TRACS. In 2023, the deadline for TRACS Coordinators to certify users was Friday, March 13th. A delay in this process could be detrimental to the property’s certification and voucher processing.

There are two types of TRACS and iMAX users: a Coordinator and a User. Coordinators usually perform functions related to administrative activities including activating a new user and assigning the user’s role and access to the applicable property. On the other hand, a user is someone other than the coordinator who has registered for a user ID from HUD and has been authorized to access TRACS voucher and/or certification data for assigned properties.

Security Awareness Training must be completed annually for both Coordinators and Users.

Additionally, a TRACS Rules of Behavior (ROB) must be accepted annually to maintain TRACS access. TRACS and iMAX applications will present users with a ROB for acceptance upon initial access to the systems, and then again annually thereafter.

Signed TRACS Rules of Behavior and Security Awareness Training certifications must be maintained for all Users/Coordinators. These files are subject to review by HUD or the Contract Administrator during oversight and monitoring responsibilities, and must be made available upon request.

If you have questions related to the security training, send an email to the Multifamily Housing Helpdesk at TRACS@hud.gov.

- The Importance of the Property Walkthrough

-

What security measures have you taken to ensure that maintenance equipment and inventory items are secure? Are your vacant units move-in ready? What actions have you taken to reduce energy consumption?

During a reviewer’s On-site Review, one vital task is the property walkthrough. These questions and many more can simply be observed during a thorough property walkthrough. The walkthrough provides the Reviewer the opportunity to make observations that are a necessary part of their review, and it provides the property Owner/Management Agent the opportunity to showcase the condition of the property.

The property walkthrough is a part of the On-site Review and is done with fidelity in order for the Reviewer to get a clearer picture of how the property is being run. The following are the potential areas that may be reviewed during a walkthrough:

Two vacant units (if available)

- Maintenance area

- Management office

- Hallways, elevators, stairs, etc.

- All building exits/entrances (including fire exits)

- Interior and exterior common areas

- Exterior of building/s

- Garbage area/s

- Parking lot

- Laundry room (if applicable)

- Property grounds

It is important for both the Reviewer and O/A to remember that an MOR cannot be adequately completed without a property walkthrough. Both parties certainly want to ensure that the property is correctly represented in the MOR Report. In addition, the property walkthrough is a great opportunity for the O/A, and maybe even a member of the maintenance staff, to share some information about the property with the Reviewer!

- HOTMA Final Rule

-

Overview

The Housing Opportunity Through Modernization Act of 2016 (HOTMA) contained fourteen sections that affect the public housing and Section 8 rental assistance programs. This final rule revises HUD regulations to implement Sections 102, 103, and 104 of HOTMA which make sweeping changes to the United States Housing Act of 1937, particularly those affecting income calculation and reviews. Only Sections 102 and 104 are applicable for Multifamily Housing, however. One of the main purposes of the statutory provisions in HOTMA is to streamline administrative processes and reduce burdens on PHAs and owners of housing assisted by Section 8 programs. This final rule is effective January 1, 2024. All provisions for Multifamily Housing programs will become effective on January 1, 2024. Owners must implement the revised regulations for all tenant certifications of income effective January 1, 2024 and after.Here is a snapshot of the two applicable sections:

- Section 102—changes requirements pertaining to income reviews for public housing and HUD’s Section 8 programs

- Section 104—sets maximum limits on the assets that families residing in public housing and Section 8 housing may have and directs public housing agencies (PHAs) to require that all applicants, for the recipients of assistance through HUD’s public housing or Section 8 programs, provide authorization for PHAs to obtain financial records needed for eligibility determinations.

Definitions

Along with the changes and revisions that this Final Rule will put into effect, several definitions have either been added or revised. Here is a snapshot of those new and revised words:New Revised Day Laborer

Independent Contractor

Real Property

Seasonal Worker

Dependent

Earned Income

Family

Health & Medical Care Expenses

Net Family Assets

Unearned Income

Summary of Changes

Here are some key points from the HOTMA Final Rule. These points are not all-inclusive but highlight some of the changes that will be taking place as of January 1, 2024.- The HUD-9887 consent form will now only need to be signed once during tenancy by each family member over the age of 18 (the form will no longer have a 15-month expiration). After all applicants or tenants over the age of 18 in a family have signed and submitted a consent form once on or after January 1, 2024, family members do not need to sign and submit subsequent consent forms at the next interim or regularly scheduled income examination.

- The elderly/disabled family deduction will increase from $400 to $525—both this deduction and the dependent deduction will be adjusted for inflation on an annual basis moving forward.

- The threshold for unreimbursed health and medical care expenses and/or attendant care and auxiliary apparatus expenses is changing from 3% to 10% of a household’s total gross annual income.

- There will be new hardship exemptions for unreimbursed health and medical care and reasonable attendant care and auxiliary apparatus expenses and child care expenses to help counteract the new 10% threshold.

- The Enterprise Income Verification (EIV) will no longer be required to be used to verify tenant employment and income information during an Interim Recertification.

- O/As will need to conduct interim recertifications when a family’s income increases/decreases by 10%.

- Owners will not be considered out of compliance for minor errors in rent calculation (no more than $30 per month in monthly adjusted income—or $360 in annual adjusted income).

- The imputed asset threshold will be raised from $5,000 to $50,000, so O/A will not need to calculate the imputed amount of assets until assets value over $50,000.

- When all net family assets have a combined value of $50,000 or less, the family is to include on its self-certification that the combined value of net family assets do not exceed $50,000, and the amount of actual income the family expects to receive from the family’s assets. This amount is to be included in the family’s income. The O/A may rely on this self-certification to serve as verification for both assets and the amount of actual income the family expects to receive from such assets.

- New restriction on the eligibility of a family to receive assistance if the family has assets in excess of $100,000.

- O/A must use a family’s income from the preceding year, taking into account any adjustment due to an interim recertification; therefore, O/As are no longer projecting long-term income for annual reviews.

Conclusion

While these changes may seem overwhelming at first, it is important to remember that HUD is implementing these updates/changes to ensure that families are provided with the best assistance possible, there is consistency across the board, and O/As are not unduly burdened with administrative tasks.As part of these changes, HUD will be updating forms HUD-50059, HUD-50059A, HUD-9887, HUD-9834, and HUD Model Leases. All of these updated forms will be published to HUDCLIPS. TRACS specifications are being finalized and will be published to the MFH TRACS webpage when complete. Lastly, the MFH plans to update HUD’s Occupancy Handbook (HUD Handbook 4350.3) to reflect HOTMA.

The HOTMA Final Rule can be accessed here and a one page fact sheet can be found here. HUD has also posted an Introduction to HOTMA webinar found here.

- New Resources for Advancing Housing Protections for Survivors of Domestic Violence, Dating Violence, Sexual Assault, and Stalking

-

On February 1, 2023, HUD announced new resources to aid in housing protections for victims under the Violence Against Women Act (VAWA). These resources include the following:

- A new VAWA website;

- A Notice outlining HUD’s enforcement authority under VAWA; and

- Up to $5 million in funding to provide VAWA training and technical assistance.

The website, which can be accessed here, contains frequently asked questions, links to applicable HUD forms (HUD-5380, 5381, 5382, and 5383), and additional resources. This site is a great resource for O/A’s to get clarification and to access HUD forms, but it is also be a great resource to provide to tenants.

The HUD Housing Notice was issued on January 20, 2023 and explains that HUD is further implementing the requirements laid out in the 2022 reauthorization of VAWA, by providing for the filing and processing of individual VAWA complaints with its Office of Fair Housing and Equal Opportunity (FHEO) and informing HUD’s covered housing providers of its authority to investigate potential violations of the applicable requirements in the housing provisions of VAWA. The FHEO will implement and enforce the housing provisions of VAWA consistent with, and in a manner that provides, the same rights and remedies as those provided for in the Fair Housing Act. In addition, HUD will engage in rulemaking and issue regulations, as appropriate, to fully implement the compliance review mandate of VAWA 2022. In the interim, as part of its authority to ensure that VAWA’s rights are fully enforced, consistent with, and in a manner that provides, the same rights and remedies provided by the Fair Housing Act, FHEO may investigate potential VAWA non-compliance, which it will do using the existing processes and approaches. Under these new VAWA requirements and implementations, there are six specific compliance items to consider:

- Compliance with requirements prohibiting the denial of assistance, tenancy, or occupancy rights on the basis of domestic violence, dating violence, sexual assault, or stalking;

- Compliance with confidentiality provisions;

- Compliance with the notification requirements;

- Compliance with the provisions for accepting documentation;

- Compliance with emergency transfer requirements; and

- Compliance with the prohibition on retaliation.

Lastly, the funding that HUD has secured will be awarded to Technical Assistance Providers (TA Providers) that will provide VAWA trainings, technical assistance and support to housing providers, grantees, and other stakeholders, to ensure that measures are being taken to educate staff on VAWA compliances.

- Member Spotlight – Sarah Harris & Sarah Watson

-

Member Spotlight – from Mark Pascoe:

CGI is excited to announce the promotion of Sarah Harris (Central Services Manager) and Sarah Watson (Local Services Manager). Both were hired early during the transition from THDA to CGI in Spring 2022 and it was evident from the start that both were a great fit for CGI. Both showed early on their leadership among their teams and demonstrated the ability to learn and adjust quickly to the numerous aspects of their role.

We look forward to their continued growth in their respective roles and the impact their leadership and guidance will provide to their teams.

Sarah Harris, Central Services Manager

Explain your position with CGI?

Explain your position with CGI?

I am the Central Services Manager for section 8 properties in TN.

How long have you been with CGI?

13 months, I started with CGI 2/1/22.What was your background prior to joining CGI?

I have a background in banking, I was a lead teller for five years. I also have 9 years of experience with processing health and death benefit life insurance claims.What are your hobbies? Things you enjoy doing after you leave the office?

Spending time with my nieces and nephews, watching great movies and everything football.What brings you the most satisfaction in your day-to-day tasks?

What brings me most satisfaction would be helping my teammates with any questions or concerns they may have.What is the best piece of advice that you could provide to an owner/agent?

My best piece of advice to owner/agents would be if you are ever in doubt about any process just ask. We would be happy to walk you through any assistance you may need.Sarah Watson, Local Services Manager

Explain your position with CGI?

Explain your position with CGI?

I am the Local Services Manager, overseeing all Management and Occupancy Reviews conducted in Tennessee.

How long have you been with CGI?

One year as of February 28th. I’m so glad to be here!What was your background prior to joining CGI?

I worked in Affordable Housing as a property manager for 10+ years.What are your hobbies? Things you enjoy doing after you leave the office?

I love to read, go for walks, and play with my dogs Penny and Rocky.What brings you the most satisfaction in your day-to-day tasks?

Knowing that what we do helps to impact lives in my state.What is the best piece of advice that you could provide to an owner/agent?

Be familiar with HUD regulations, watch for updates to the regulations, and don’t be afraid to ask questions. - Contact Center Posting/Information

-

All Residents of HUD Subsidized Properties (Click here for pdf printable version)CGI provides Performance-Based Contract Administration (PBCA) services to the Tennessee Housing Development Agency (THDA) and is responsible for responding to resident concerns. The CGI Contact Center has a team of Customer Relation Specialists(CRS) who will receive, investigate and document questions and concerns you may have, such as, but not limited to the following:

- Questions or concerns regarding work order follow-up.

- Questions regarding the calculation of your rent.

- Address health & safety and HUD Handbook 4350.3 concerns.

Call Center Purpose:

- Call Center aids in ensuring HUDs mission of providing Decent, Safe and Sanitary Housing.

- Serve as a neutral third party to residents, owners and the public.

- Assist with clarifying HUD Occupancy Handbook 4350.3 requirements.

Call Center Contact Information and Business Hours:

- Hours of Operation: Monday-Friday, 8:00am to 5:00pm (Central; 9:00am -6pm Eastern

- Contact Numbers: 888-384-3540 fax: 614-985-1502 (leave message after hours)

- Written Summaries: 8760 Orion Place, Suite 110, Columbus, Ohio 43240

- Email: PBCAContactCenter@cgifederal.com

- Website: www.TNPBCA.com

Concerns can be submitted by the following:

- Phone

- Fax

- Voicemail

- FOIA- Freedom of Information Act request must be submitted directly to HUD

Required Information to open an inquiry:

- Property name

- Caller’s name (anonymous calls accepted)

- Caller’s telephone number with area code

- Caller’s address including apartment number

- A brief, detailed description of the caller’s concern(s)

CGI Federal

8760 Orion Place • Suite 110 • columbus, oh • 43240-2007

Contact center TTY: 800-848-0298 • Spanish TTY: 866-503-0263

Closing Thoughts-

If you are not already receiving this publication via e-mail, or if you have ideas, suggestions, or questions for future publications, we’d like to hear from you. Please send an email to andrew.hill@cgifederal.com